Welcome to non profit charity platform

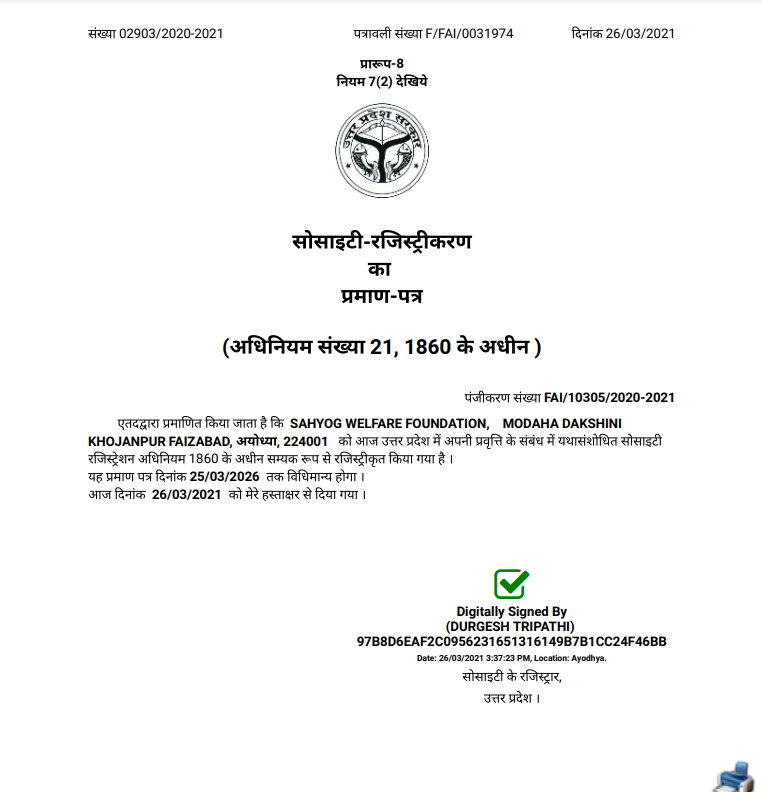

This certificate acknowledges Sahyog Welfare Foundation's dedication to addressing the needs of the underserved and marginalized populations, including but not limited to providing access to education, healthcare, livelihood opportunities, and social support services.

Sahyog Welfare Foundation Ayodhya has met the necessary criteria and requirements for registration as an NGO, including compliance with legal and regulatory standards, transparency in governance, and accountability in its operations.

By receiving this certificate of registration, Sahyog Welfare Foundation Ayodhya is recognized as a legitimate and credible organization working towards the betterment of society.

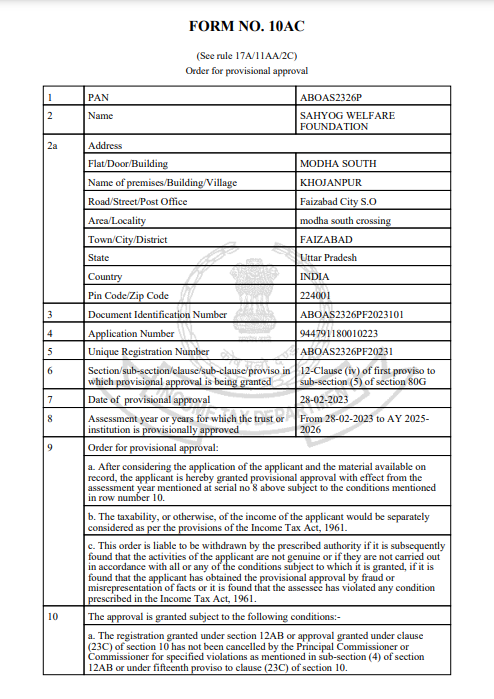

This certificate acknowledges Sahyog Welfare Foundation's commitment to carrying out genuine charitable activities aimed at promoting social welfare and community development. Donations made to Sahyog Welfare Foundation Ayodhya are eligible for deduction from the taxable income of the donor, subject to the limits and conditions specified under Section 80G of the Income Tax Act.

By availing tax benefits under Section 80G, donors can support Sahyog Welfare Foundation's noble initiatives while also reducing their tax liabilities. This certificate serves as evidence of Sahyog Welfare Foundation's compliance with the necessary requirements and regulations for obtaining approval under Section 80G.

We encourage individuals and organizations to contribute to Sahyog Welfare Foundation's philanthropic endeavors, knowing that their donations will not only make a positive impact on society but also provide tax relief in accordance with applicable laws. Issued on behalf of the tax authority,

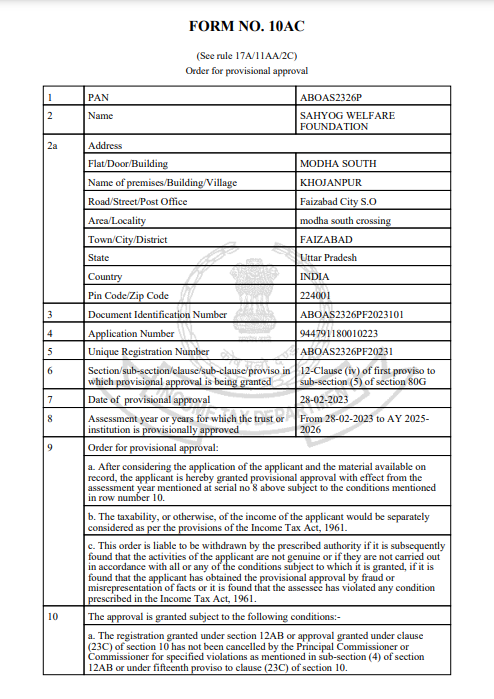

This is to certify that Sahyog Welfare Foundation Ayodhya has been granted registration under Section 12A of the Income Tax Act, 1961. Sahyog Welfare Foundation Ayodhya is recognized as a charitable organization engaged in activities aimed at promoting social welfare and community development.

This certificate acknowledges Sahyog Welfare Foundation Ayodhya's compliance with the necessary criteria and regulations for obtaining registration under Section 12A of the Income Tax Act. As a result, Sahyog Welfare Foundation Ayodhya is exempt from paying income tax on its income derived from charitable activities.

By obtaining registration under Section 12A, Sahyog Welfare Foundation Ayodhya is eligible to receive donations and contributions without attracting income tax liabilities. Donors can support Sahyog Welfare Foundation Ayodhya's initiatives with the assurance that their contributions will directly contribute to the organization's charitable endeavors.

Sahyog Welfare Foundation Ayodhya, "Rules of Association" refer to the set of guidelines, principles, and regulations that govern the organization's structure, operations, and decision-making processes. These rules outline how the NGO is structured, how it functions, and the rights and responsibilities of its members and governing body.

These rules serve as the framework for the organization's operations, ensuring clarity, transparency, and accountability in its activities. They provide guidance to members, staff, and stakeholders on how the organization functions and how decisions are made. Additionally, adherence to these rules is often a requirement for maintaining legal and regulatory compliance as an NGO.

A PAN card is essential for Sahyog Welfare Foundation Ayodhya to establish its legal identity, ensure tax compliance, facilitate financial transactions, and maintain transparency in its operations. It plays a crucial role in the organization's administrative and financial management processes.